The Book I Found In A Dumpster That Made Me $80,000...

There I was, rifling through one of probably 40 different dumpsters.

I'd already made my rounds at the dump that day, looking in this bin and that.

Sure, there were a few decent finds, but this dumpster I was picking around in...

It was about to change my life forever.

I had just hopped in (yes, my whole self inside the dumpster) and was digging through what seemed to be some old office supplies...

It was almost as if a secretary had tossed everything that was in her office right into this bin.

Then I saw it: "YOU CAN CHOOSE TO BE RICH!" by Robert Kiyosaki.

It was a handsome package, containing a couple workbooks and a few cd's. The title intrigued me.

I grabbed it and took it home, thinking to myself: "Who is this Robert Kiyosaki guy?"

After some brief research some days later, I realized that the name sounded familiar because I'd seen it before.

At the age of 13, my parents had given me a list of impactful books to read to expand my mind, heart, and spirit.

Rich Dad, Poor Dad was on the list.

Upon connecting the dots, I got my hands on "Rich Dad, Poor Dad," "Cashflow Quadrant" and any other Kiyosaki materials that were available online or in used bookstores, and started devouring them like a ferocious animal.

Everything.

These ideas... These concepts... These simple, yet paradigm shifting diagrams... It was like drinking from a gushing fire hydrant–

of fire.

My pencil sketched 5-year plans were going up in flames. You know, the plans like:

Become an EMT firefighter and pay my way through college...

Make up some hodgepodge interdisciplinary degree that my school didn't even offer as a program (something foreign language oriented) and try to graduate with zero debt...

Become some sort of minister (well, still did that in a manner of speaking 😉)...

All of it was disentigrating before my eyes because... Well, no one had ever told me anything like this before!

Assets, liabilities, cash flow, thinking like the rich, not working for money...

I'd never considered "real estate" or "asset based income" as viable pursuits because I'd never even heard of them.

My high school classes were fresh out of such ground breaking content.

All of a sudden, I knew exactly what I wanted to do:

Buy my first property, and stuff my balance sheet full of cash flowing assets like there's no tomorrow–just like Rich Dad.

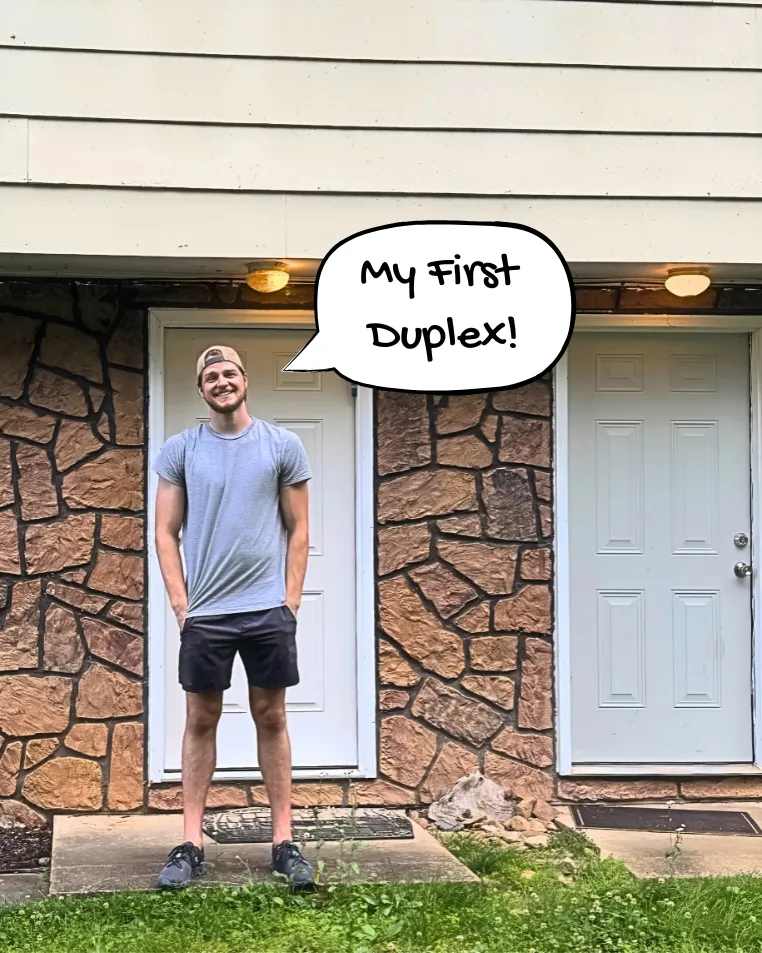

Fast forward to age 21 - I bought my first duplex with only $3,945.09 out of pocket.

That's not a typo.

Less than four grand to buy my first property.

Most people think you need a massive down payment and perfect credit to accomplish this. They're wrong.

I'm living proof that anyone can do this with the right strategy.

That's why I created EasyFirstProperty.com–to show you how to get your hands on your first property.

I break everything down into simple steps that actually work. No BS, No fluff.

Want to know how I did it?

I'm sharing the strategies I used in my almost daily newsletter.

>>> Click Here To Join My Email List

Real estate changed my life.

Now I help others change their lives by buying their first property.

This is who I am. From dumpster diver to property investor to your guide.

Let me show you how to change your life with real estate.

-Jonathan

My Latest Articles

How To Build Your Power Team

How To Build Your Power Team

They say, “Rome wasn’t built in a day.”

And, as anyone who's ever tried to assemble IKEA furniture knows, it definitely wasn’t built by just one guy.

When I started shopping for my first deal, I quickly learned that if you want to win, you’ve got to assemble a power team.

It’s not optional. Real estate isn’t a solo sport.

It’s like basketball—you need someone to pass the ball, someone to take the shot, and someone to grab the rebounds.

Here is the team that I started to assemble to help me buy my first rental property:

1. The Mentor

If you’ve been reading these newsletters, you already know I hired a real estate coach He . It wasn’t cheap. But to put it curtly, I swiped my card because I wanted to buy his confidence. I had never purchased a property before, but when I hired him, all of a sudden I had his expertise on my side. I wasn’t just mooching an answer to a question now and then… I put my money where my dreams were and took the risk. I showed him that I meant business, but I also showed myself that I was taking this seriously and that I wasn't going to put off buying my first deal any longer.

I can’t stress this enough: find a mentor. Someone who’s been in the game longer than you, who’s already made the mistakes so you don’t have to. Trust me, it’s worth every penny.

2. The Lender

Next, I had my lender. His job wasn’t just to get me prequalified—it was to make me look good to the underwriters. These are the folks who hold the keys to the kingdom, deciding if you’re worthy of the loan. Lucas’s ability to explain my finances in a way that made sense to the underwriters, and convinced them to hand me nearly $100,000 was clutch.

He also helped me navigate some of the more stressful parts of the process, like when I thought I wouldn’t have enough cash reserves to qualify. We were able to use cash invested in securities as “reserves.” Spoiler alert: I had exactly what I needed to buy the house.

Until you step into the "Creative Finance" space of real estate, everything starts with getting pre qualified.

More on this to come.

3. The Realtor

Until this point in my career, I had been involved in quite a few transactions. I'd sold dozens of houses and worked on the lending side of the table dozens of time... but actually being the guy to walk the properties, make real offers, send real earnest money, and sign on the dotted line for the biggest asset that most Americans EVER purchase... that was all new to me. I especially needed help regarding the purchase agreement. I hadn't signed one of those for an on-market real estate deal before, and if you have done a deal or two, you know it is a LOT of paperwork

Enter my real estate agent. This is the person who helped me find properties, make offers, negotiate deals, and hold my hand through the entire process.

Pro tip: your realtor isn’t just there to find properties—they’re your first line of defense against making a bad investment. My STRONG recommendation for you is to find a real estate agent who is an experienced real estate investor. Everyone and their 3rd cousin's dog has a real estate license nowadays, and it takes some networking to find a trustworthy agent.

4. The Insurance Guy

Insurance is like the broccoli of real estate: you don’t want to deal with it, but you know you have to.

When I bought my first rental property, I learned that regular homeowners’ insurance wouldn’t cut it. I needed landlord insurance, which is a special kind of coverage that protects your property when you’re renting it out.

My insurance guy walked me through the options, explained the coverage limits, and helped me find a plan that wouldn’t break the bank. Now, I sleep easier knowing my investment is protected.

Especially when things went TERRIBLY wrong... I'll save that story for another day, but just know a LOT of water was involved, and insurance was needed.

5. The Contractors

These folks are the unsung heroes of real estate. They’re the ones who turn a house with questionable carpet and peeling paint into something you can rent out for top dollar. My contractors included a master electrician, a jack of all trades, a couple of carpet guys, and my parents. (We did much of the work, but not all.)

For this property, I needed upgrades—new flooring, a fresh coat of paint, some plumbing fixes, electrical panels, mini splits, drywall, cabinets... staying on schedule and Without them, it would have been nearly impossible for me to make this deal a successful investment.

If you’re building your team, take the time to vet your contractors. Look at their reviews, ask for references, and—most importantly—make sure they show up when they say they will. The best way I have found contractors is by referral.

6. The Title Company

Think of the title company as the referee in your real estate game. Their job is to ensure the transfer of ownership is clean and legal, free of surprises like liens or unresolved disputes. For my first deal, the title company walked me through the title search process, ensured all the paperwork was buttoned up, and even handled the final disbursement of funds. It was like having an impartial coach on the sidelines, making sure everything ran smoothly.

Here’s the truth: a good title company doesn’t just handle the paperwork—they’re your peace of mind. When you’re making one of the biggest financial decisions of your life, you want to know the ground you’re standing on is solid, literally and legally. If you’re building your power team, don’t overlook this critical player.

Building Your Empire

The point of all this?

Whether you’re building Rome or buying your first rental property, you can’t do it alone. You need a team. And not just any team—a great team. One that complements your strengths, compensates for your weaknesses and helps you see things you might otherwise miss.

You cannot win at a team sport on your own.

We will discuss all of this and more in issues to come.

Talk soon,

Contact Me!