The Book I Found In A Dumpster That Made Me $80,000...

There I was, rifling through one of probably 40 different dumpsters.

I'd already made my rounds at the dump that day, looking in this bin and that.

Sure, there were a few decent finds, but this dumpster I was picking around in...

It was about to change my life forever.

I had just hopped in (yes, my whole self inside the dumpster) and was digging through what seemed to be some old office supplies...

It was almost as if a secretary had tossed everything that was in her office right into this bin.

Then I saw it: "YOU CAN CHOOSE TO BE RICH!" by Robert Kiyosaki.

It was a handsome package, containing a couple workbooks and a few cd's. The title intrigued me.

I grabbed it and took it home, thinking to myself: "Who is this Robert Kiyosaki guy?"

After some brief research some days later, I realized that the name sounded familiar because I'd seen it before.

At the age of 13, my parents had given me a list of impactful books to read to expand my mind, heart, and spirit.

Rich Dad, Poor Dad was on the list.

Upon connecting the dots, I got my hands on "Rich Dad, Poor Dad," "Cashflow Quadrant" and any other Kiyosaki materials that were available online or in used bookstores, and started devouring them like a ferocious animal.

Everything.

These ideas... These concepts... These simple, yet paradigm shifting diagrams... It was like drinking from a gushing fire hydrant–

of fire.

My pencil sketched 5-year plans were going up in flames. You know, the plans like:

Become an EMT firefighter and pay my way through college...

Make up some hodgepodge interdisciplinary degree that my school didn't even offer as a program (something foreign language oriented) and try to graduate with zero debt...

Become some sort of minister (well, still did that in a manner of speaking 😉)...

All of it was disentigrating before my eyes because... Well, no one had ever told me anything like this before!

Assets, liabilities, cash flow, thinking like the rich, not working for money...

I'd never considered "real estate" or "asset based income" as viable pursuits because I'd never even heard of them.

My high school classes were fresh out of such ground breaking content.

All of a sudden, I knew exactly what I wanted to do:

Buy my first property, and stuff my balance sheet full of cash flowing assets like there's no tomorrow–just like Rich Dad.

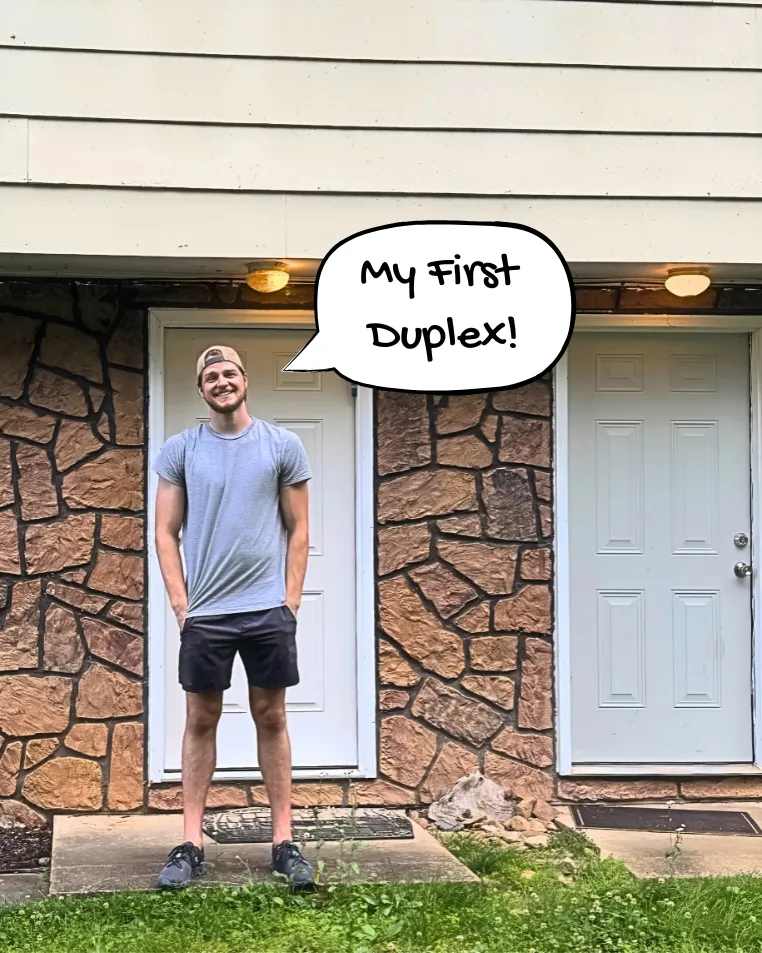

Fast forward to age 21 - I bought my first duplex with only $3,945.09 out of pocket.

That's not a typo.

Less than four grand to buy my first property.

Most people think you need a massive down payment and perfect credit to accomplish this. They're wrong.

I'm living proof that anyone can do this with the right strategy.

That's why I created EasyFirstProperty.com–to show you how to get your hands on your first property.

I break everything down into simple steps that actually work. No BS, No fluff.

Want to know how I did it?

I'm sharing the strategies I used in my almost daily newsletter.

>>> Click Here To Join My Email List

Real estate changed my life.

Now I help others change their lives by buying their first property.

This is who I am. From dumpster diver to property investor to your guide.

Let me show you how to change your life with real estate.

-Jonathan

My Latest Articles

How To Get Prequalified For A Mortgage (Financial Colonoscopy)

How To Get Prequalified For A Mortgage (Financial Colonoscopy)

When I first considered working with my real estate coach, I really didn't think that it would be all motivation and mindset—the dreamy “woo-woo” stuff we have been talking about for the past month or so. I signed up and paid the fee because I wanted to take action. I couldn’t have been more wrong.

Right out of the gate, I had 3 assignments.

First, I wrote out a vision for my life—a brain dump of every dream I could imagine. It wasn’t about having practical steps to achieve those dreams right away, it was about burning everything to the ground: thinking as big as possible, no matter how impossible it seemed.

Then I created a personal financial statement. This would come in handy for the action steps my coach assigned soon after.

And finally, the heaviest one: I wrote my own eulogy. That one was a monster energy drink for my motivation.

After turning in those assignments, I wondered, What’s next?

Can we get to the real estate already?

Turns out, the real work was just beginning.

My coach kept pushing me to take action, and soon I had more tasks on my plate. He sent me books to read—books that completely changed my outlook on money, business, and life.

Here’s a few of volumes on the list:

I dove in and devoured them. These books weren’t just tips and theories; they were frameworks that shifted my thinking. If you haven’t read them yet, go grab a copy of each.

Reading was just the start.

What was the big goal? What was the reason I swiped my card in the first place?

My mission was:

To buy my first rental property, and in so doing, learn a simple real estate investing strategy that I could use as a tool to make my dreams a reality.

The Plan

Together, my coach and I worked out the game plan.

We weren’t just looking for any old property—it had to check a few key boxes:

Affordability: As I would soon find out, I couldn't afford to buy a 27 unit apartment complex. I would have to find a property that was under $130k.

Sweat Equity: We needed a property with room for improvement—a fixer-upper where I could put in just the right amount of sweat equity and add significant value.

Scope of Work: This ain't HGTV. Ya boi couldn't sign on the dotted line for a total gut job. i was after a deal that required as little renovation as possible.

Live-In Potential: I hadn’t moved out of my parents’ house yet, and my coach insisted I buy something I could live in. He wanted me to feel the responsibility of homeownership firsthand, and he was right. That experience was invaluable.

Rental Income: The property also had to have rental potential, whether that was renting out rooms or a full unit to help cover the mortgage.

And step one? Getting pre-qualified for a mortgage.

The Prequalification Process

Now, I had a little experience here—I was working as a licensed mortgage loan officer at the time. But applying for a mortgage as the borrower? That was an entirely new ballgame.

If you’ve never applied for a mortgage, here’s what you can expect:

Income Docs:

2 Years W-2 Forms

2-Years of Tax Returns

30 days worth of Pay Stubs

Additional Income Documentation: You may need to provide proof of income from bonuses, commissions, alimony, child support, Social Security benefits, or military rental properties.

Proof of Assets:

Gift Letters: If using gift funds for the down payment, include a letter stating the money is a gift and not a loan.

Bank Statements: Statements from checking and savings accounts for the past two months.

Investment Account Statements: Recent statements from retirement accounts, stocks, bonds, or other investments.

Additionally, you will have to provide:

Employer Information: Names and addresses of employers for the past two years.

Self-Employment Documentation: If self-employed, provide business tax returns for the last two years and a year-to-date profit and loss statement.

Photo ID: A valid driver's license, state ID, or passport.

Social Security Number: Your Social Security card or Individual Taxpayer Identification Number (ITIN).

Residential history (often the past 2 years, every address you have Social Security number, recent financial documents (like bank statements and pay stubs), and your credit history.

To put it bluntly, the lender will give you a financial colonoscopy if you are a new borrower.

And still...

Getting the green light from a lender isn't the finish line—it is just the starter pistol.

Once I submitted the mortgage application, it was time to build my team.

I can't wait to tell you more.

Talk soon,

-Jonathan

Contact Me!